We’ve seen it countless times.

A shopper browses your store, adds to the cart, and then… freezes.

“Can I afford this right now?”

“What if I wait until next week’s paycheck?”

“Is there a better deal coming up?”

In that moment of hesitation…

You don’t lose the product, you lose the purchase.

But what if your brand could say:

“Don’t worry. Take it now. Pay later — no interest.”

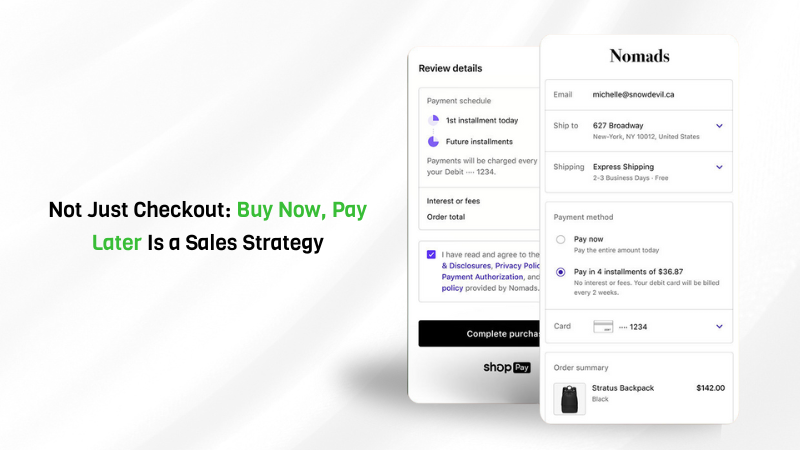

That’s the power of Buy Now, Pay Later (BNPL).

As Shopify experts in India, Binary is enabling brands to turn BNPL from a payment option into a strategic growth engine.

BNPL Is More Than a Payment Button

It’s easy to treat BNPL like just another payment provider on your Shopify store.

But here’s the reality: it influences every part of the customer journey.

From discovery to checkout, BNPL changes:

- How did customers perceive price?

- How often do they return?

- How much are they willing to spend?

Think of it less as “pay later” and more as “buy confidently now.”

What the Numbers Say?

We don’t love jargon. But we trust good data:

- 45% of shoppers say they won’t complete a purchase without BNPL options

- BNPL increases AOV by up to 55% for Shopify merchants

- Shopify stores offering BNPL report 20–30% more repeat customers

If you’re a growing D2C brand in India, these are not optional wins — they’re competitive advantages.

Shopify + BNPL = Seamless Selling

Thanks to Shopify’s powerful checkout ecosystem, BNPL isn’t a bolted-on afterthought.

It’s baked into the buying experience — mobile – optimised, frictionless, and fully trackable.

Binary, as a Shopify Plus Partner, ensures you don’t just add BNPL — you activate it.

We integrate:

- Shop Pay Installments for global brands

- Simpl, LazyPay, and Razorpay BNPL for Indian markets

- UX updates across PDPs, cart, and checkout to promote payment flexibility

All stitched into your Shopify admin. Clean, compliant, and conversion-ready.

Where BNPL Impacts Most?

Let’s break it down. BNPL isn’t a fit for every store — but when it fits, it transforms.

Beauty & Wellness:

Encourages multi-product bundles & subscriptions

“₹299 now, the rest next month.”

Fashion & Lifestyle:

Helps customers justify higher-ticket or impulse items

“Look good now, pay over time.”

Health Tech & Smart Gadgets:

Improves accessibility for mid-range electronics or wellness products

“No credit card? No problem.”

Binary’s BNPL Activation Stack

Our team of e-commerce experts in India helps you roll out a BNPL system that’s not just functional, but fully optimized. Here’s what we include:

- Payment partner mapping — Simpl, ZestMoney, Shop Pay, Klarna, etc.

- Shopify theme integration — badges, prompts, and microcopy placement

- Analytics tagging — track BNPL adoption vs. standard checkout

- Campaign support — promote BNPL during sale spikes and festive seasons

- Legal & trust compliance — T&C pages, consent collection, refund flows

Real Talk: What Brands Often Miss

BNPL isn’t a plug-and-play fix. It’s a tool — and tools need technique.

What most brands skip:

- Promoting BNPL upfront (on product pages, not just at checkout)

- Localising the provider (Indian users don’t want foreign fintech UX)

- Custom messaging like “Pay ₹349 today, no extra cost later”

- Educating customers that it’s safe, secure, and interest-free

At Binary, we work across teams — marketing, tech, CX — to ensure your BNPL isn’t just installed… It’s performing.

Final Thought: This Is a Mindset Shift

E-commerce isn’t about selling more. It’s about removing what’s in the way of a sale.

And for modern consumers, upfront cost is often the barrier.

BNPL erases that — ethically, flexibly, and profitably.

As Shopify experts and Shopify Plus Partners, Binary helps forward-thinking brands reimagine checkout as a growth channel — not a bottleneck.

Ready to Make Checkout a Conversion Catalyst?

Let Binary — the e-commerce experts in India — guide your Shopify store to activate BNPL the right way.

More orders. Higher AOV. Happier customers. Fewer abandoned carts.

Let’s build smarter, together.